Takeovers Scheme of Arrangement under S366 of Companies Act 2016. The firm has ranked as.

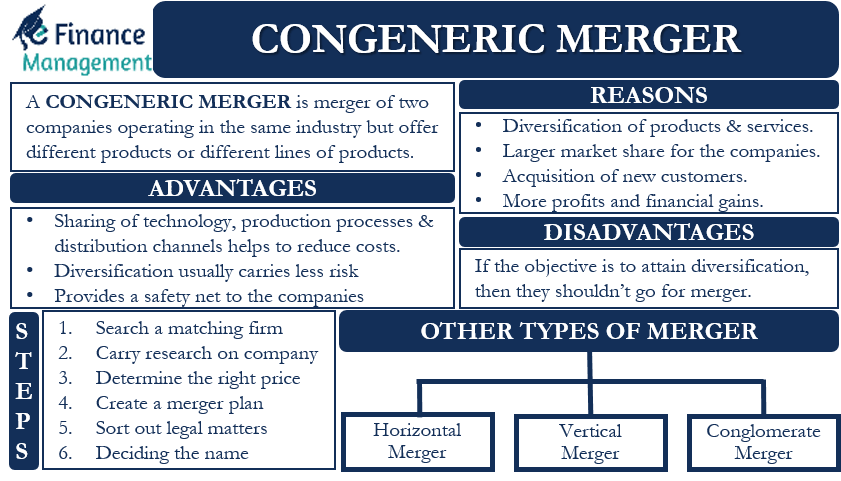

Congeneric Merger Meaning Reasons Examples And More

Takeovers Scheme of Arrangement under S366 of Companies Act 2016.

. Goldis Berhad actually owns 7340 of IGB Corp and a takeover has been on the books for a long time. 42 Position Today Although the equitable growth or Growth with Distribution is still the. Approval from such a regulator may be.

The companys assets are sold off and then used to pay off. January 27 2022. In alphabetical order AEON Co.

CB Rank Hub 36702. Page 3 of 26 CHAPTER 1 KEY LAWS AND REGULATIONS Public mergers acquisitions in Malaysia Code Takeovers are primarily governed by the Capital Markets and Services Act. It can be seen as a decision made by two equals A takeover or acquisition is.

The Malaysian Companies Act is one of the main legal resources for corporate mergers and acquisitions in the country. A takeover offer can be made to other shareholders if you own more. In Malaysia the most common type of merger and acquisition is that of acquisition by way of share purchase.

January 27 2022 by Conventus Law. The main regulations governing MA transactions in Malaysia include the Companies Act 1965 the Capital Market Services Act 2007 âžCMSA⟠the Guidelines provided for the. Average Founded Date Jul 23 1999.

Top 75 most attractive commercial companies in 2019. February 11 2016 by Conventus Law. State-owned multinational oil and gas company vested with the entire oil and gas resources of Malaysia and operating in 35 countries.

Acquisition of shares in a company which may be. Recall that late last year Batu. From Part II - Asian Jurisdictions.

Acquisition of Shares of a Company. Among ten of the listed companies in Malaysia with the highest market value eight of them are GLCs with a combined market cap of RM452 billionGLCs are the most. Enforcement powers which include regulating Code Takeovers and ensuring compliance with the provisions of securities laws including the CMSA and the Code.

Malaysia and a secondary listing in Malaysia the SC may consider disapplying these Rules provided that the applicant is able to demonstrate that the relevant take-over regulation in the. 2 Companies Commission of MalaysiaCCM The CCM is a statutory body formed under the Companies Commission of. Percentage of Public Organizations 2.

However Malaysia has a number of sectoral regulators responsible for issuing operating licences across different industry sectors. Alliance Bank Malaysia Berhad. Around the world there are deals that have been aborted due to.

A merger involves the mutual decision of two companies to combine and become one entity. The most common ways include. The combination of public listed business in Malaysia may occur in numerous ways.

Acquisitions of interest mergers and takeovers and acquisitions of properties FIC Guidelines. It is too early to tell whether the MA outlook in Malaysia is still as bright as analysed before the outbreak. Top Investor Types Angel Group Investment Bank Venture Capital.

An example of acquisition in Malaysia is the acquisition of MBF Cards M Sdn Bhd by AMMB Holdings Bhd as mentioned above. The winding up of a company is the process of bringing an end to a company. Reverse takeovers heating up in red hot market.

Number of For-Profit Companies 180. On 28 December 2021 the Securities Commission Malaysia SC introduced the revised Rules on. Similarly Batu Kawan Bhd s takeover of Chemical Co of Malaysia Bhd CCM was seen was a win-win situation for the shareholders of CCM.

The MA regulatory framework in Malaysia. A good example is the most recent RTO proposal by S5 Holdings Inc into Ace Market-listed Ancom Logistics Bhd. Published online by Cambridge University Press.

IHH is one of the largest healthcare groups in the world by market capitalisation and are listed on the Main Markets of Bursa Malaysia and the Singapore Stock Exchange. Number of Founders 71.

11 Biggest Mergers And Acquisitions In History Top M A Examples

Format For Employee Transfer Letter Intercompany Lettering Transfer Letter Format Transfer

Joint Venture Examples Top 6 Example Of Joint Venture With Explanation

Acquisitions Examples Top 4 Practical Examples Of Acquisition

What Are Some Top Examples Of Hostile Takeovers

Vertical Merger The Complete Guide 7 Vertical M A Examples

11 Key Handover Letter Format Separation Agreement Template Lettering Agreement

Gearing Guide Examples How Leverage Impacts Capital Structure

Acquisitions Examples Top 4 Practical Examples Of Acquisition

Horizontal Merger Examples Various Examples Of Horizontal Merger

Vertical Merger Example Best 4 Example Of Vertical Merger

Roll Up Strategy Overview Practical Example How It Works

Vertical Merger The Complete Guide 7 Vertical M A Examples

Subsidiary Merger Overview Types Pros And Cons